Akouba Overview

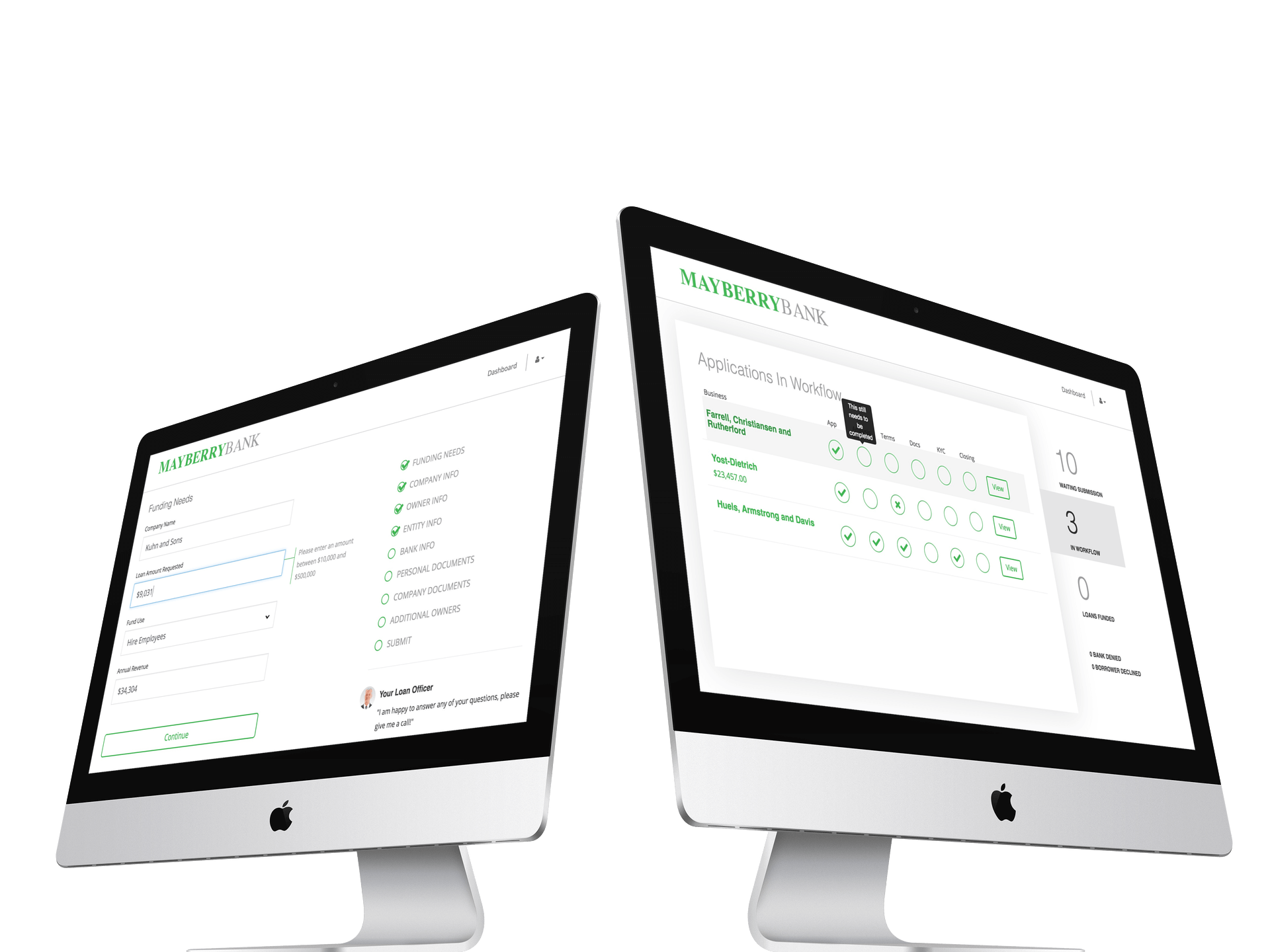

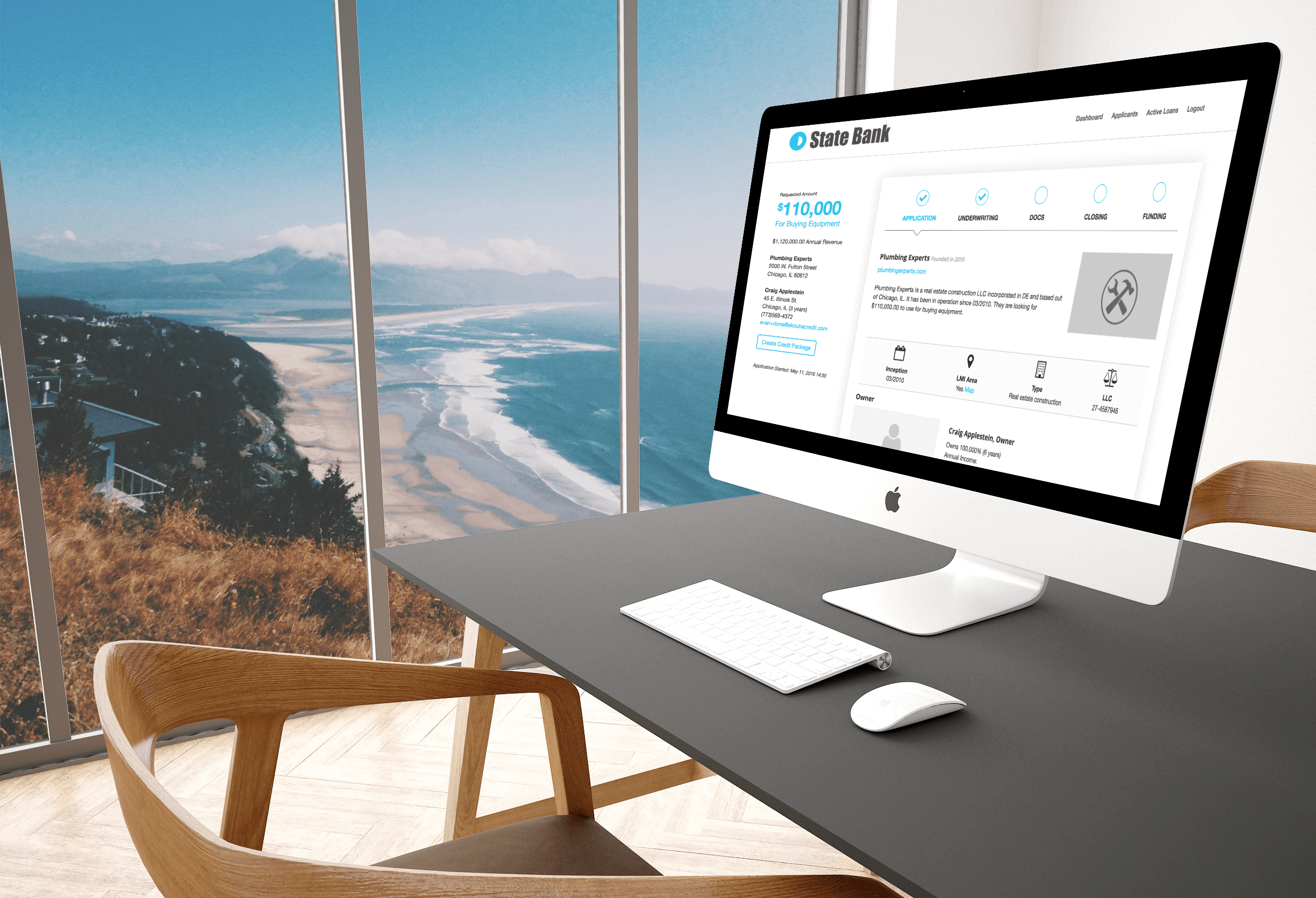

Akouba is a SaaS-based platform designed for banks to create a better experience for small business lending. The platform enables bankers and small businesses to collaborate on documentation and processes involved in loan origination. The platform consists of an online borrower application and a banker's portal.

My Role

My contributions at Akouba include Front End Development, User Experience, Visual Design, Product Research, Product Management, and Branding. As the solo designer and front end developer, I was able to use all my strengths to fill requirements that span across the entire product side.

Research

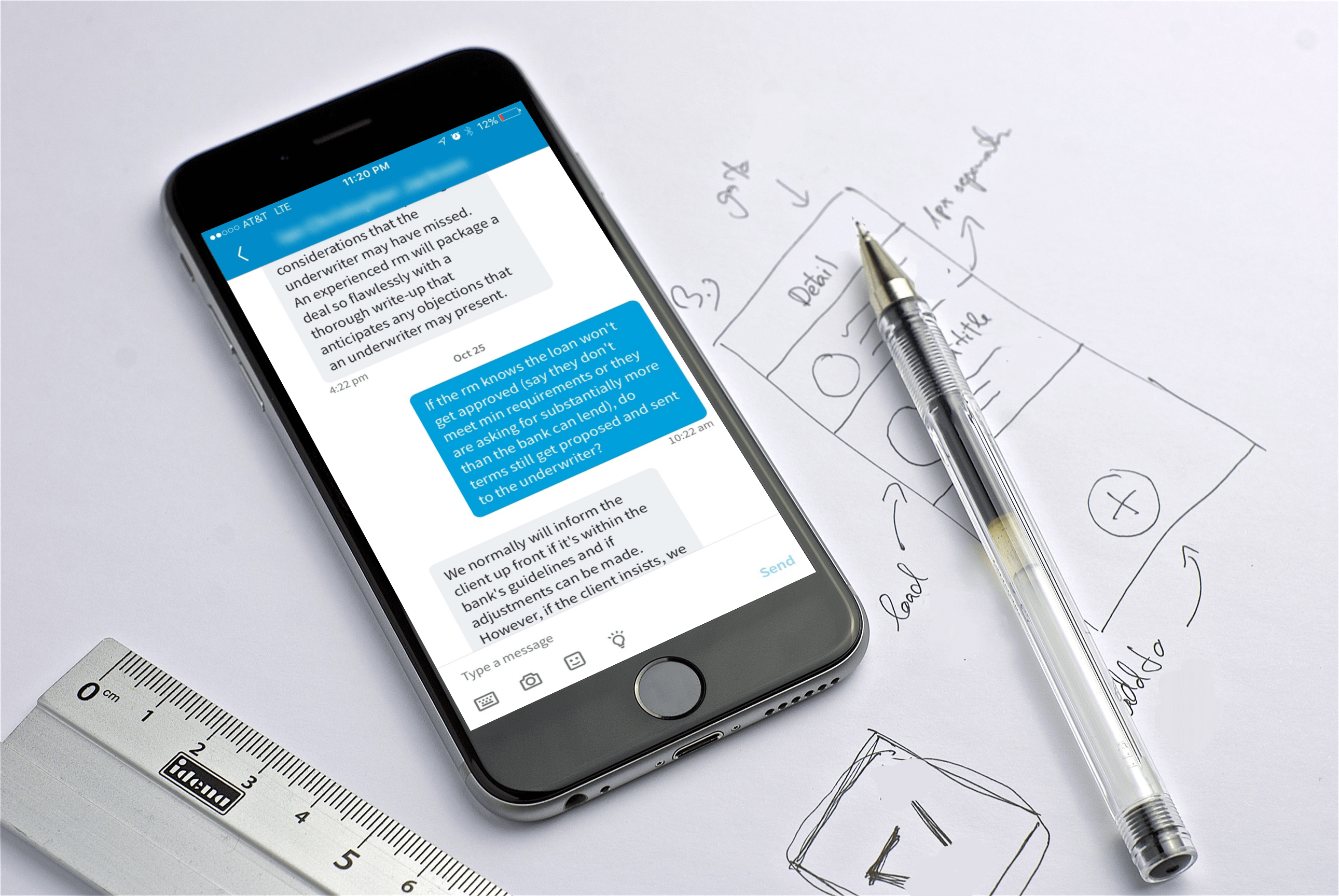

Throughout the last year, I’ve had to dig into an industry that is largely kept under wraps. Who likes to talk about money? And what bank puts their processes online for the world to see? This required me to network with banking professionals and small business owners. I even sifted through yelp reviews searching for the reasons people get loans and tried to understand the emotions that are involved in it. Did you know you can get kicked off yelp for sending too many direct messages?

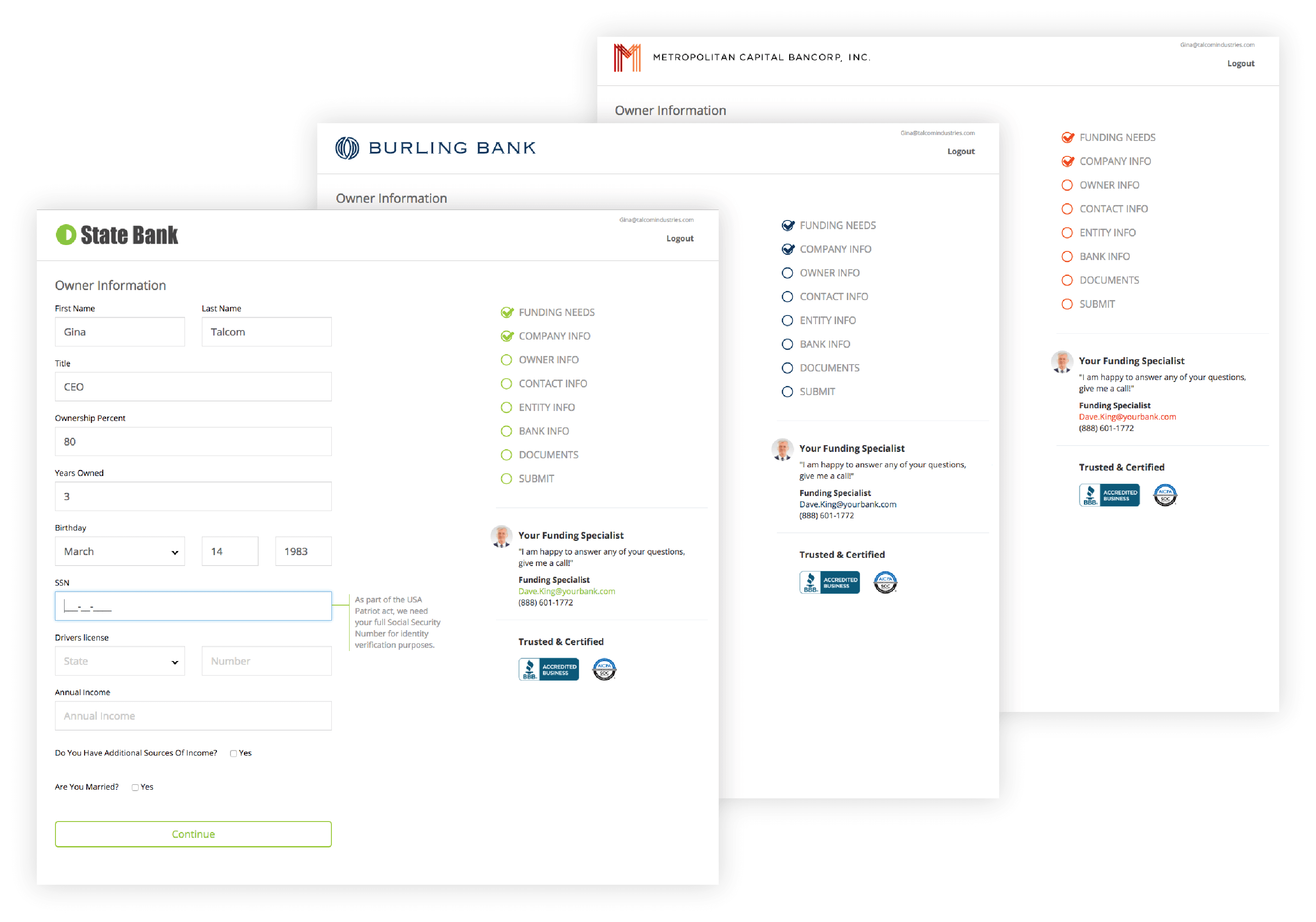

Borrower Portal

In early 2016 we released a new white-labeled version of our borrower application, it used gamification techniques and included an easy modular approach that allows a borrower to fill out only what’s needed based on the other answers they have provided.

Businesses with multiple owners can easily invite their co-owners by simply adding their email. The overall goal is to give an owner a way to quickly fill out an application and submit from anywhere.

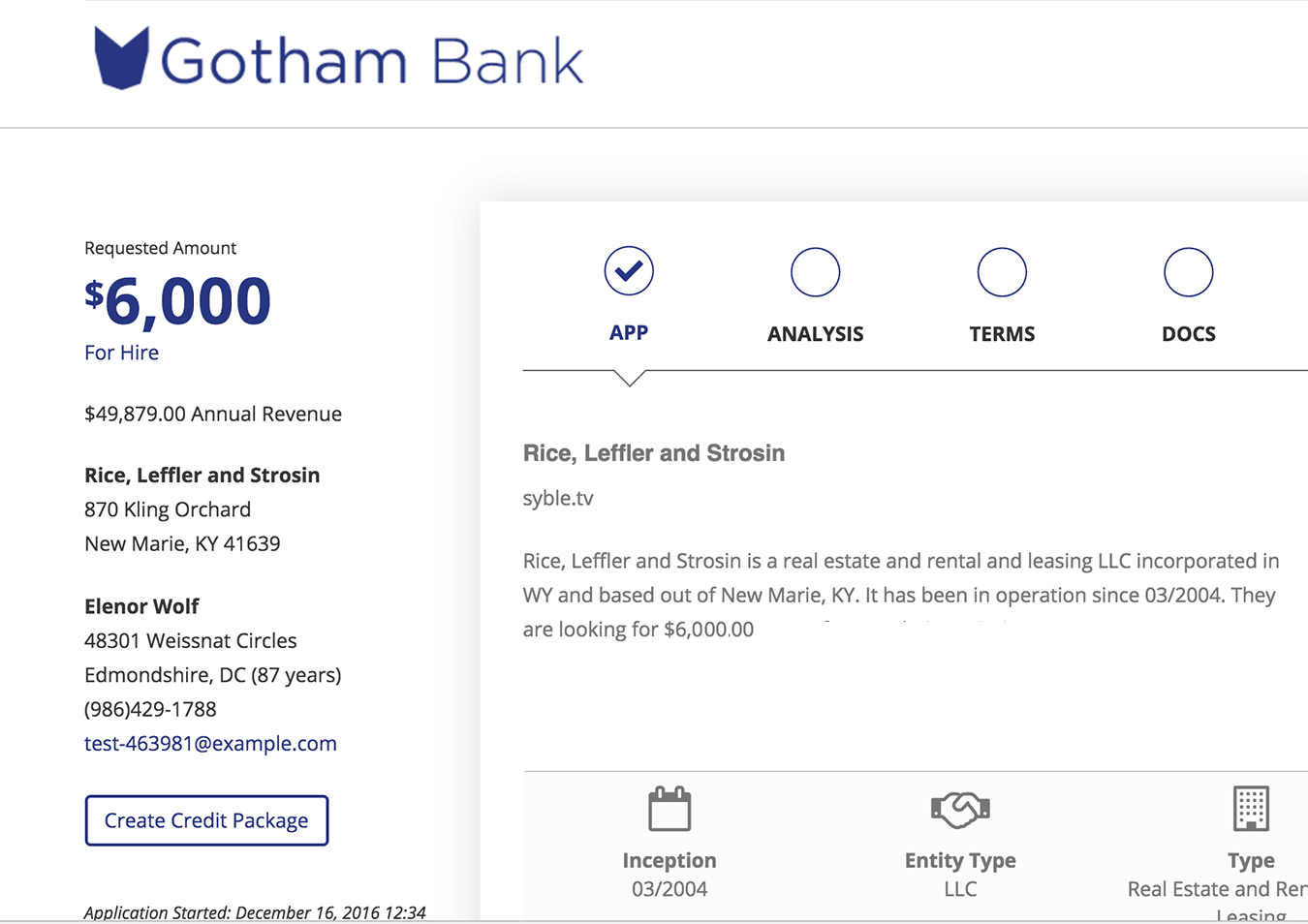

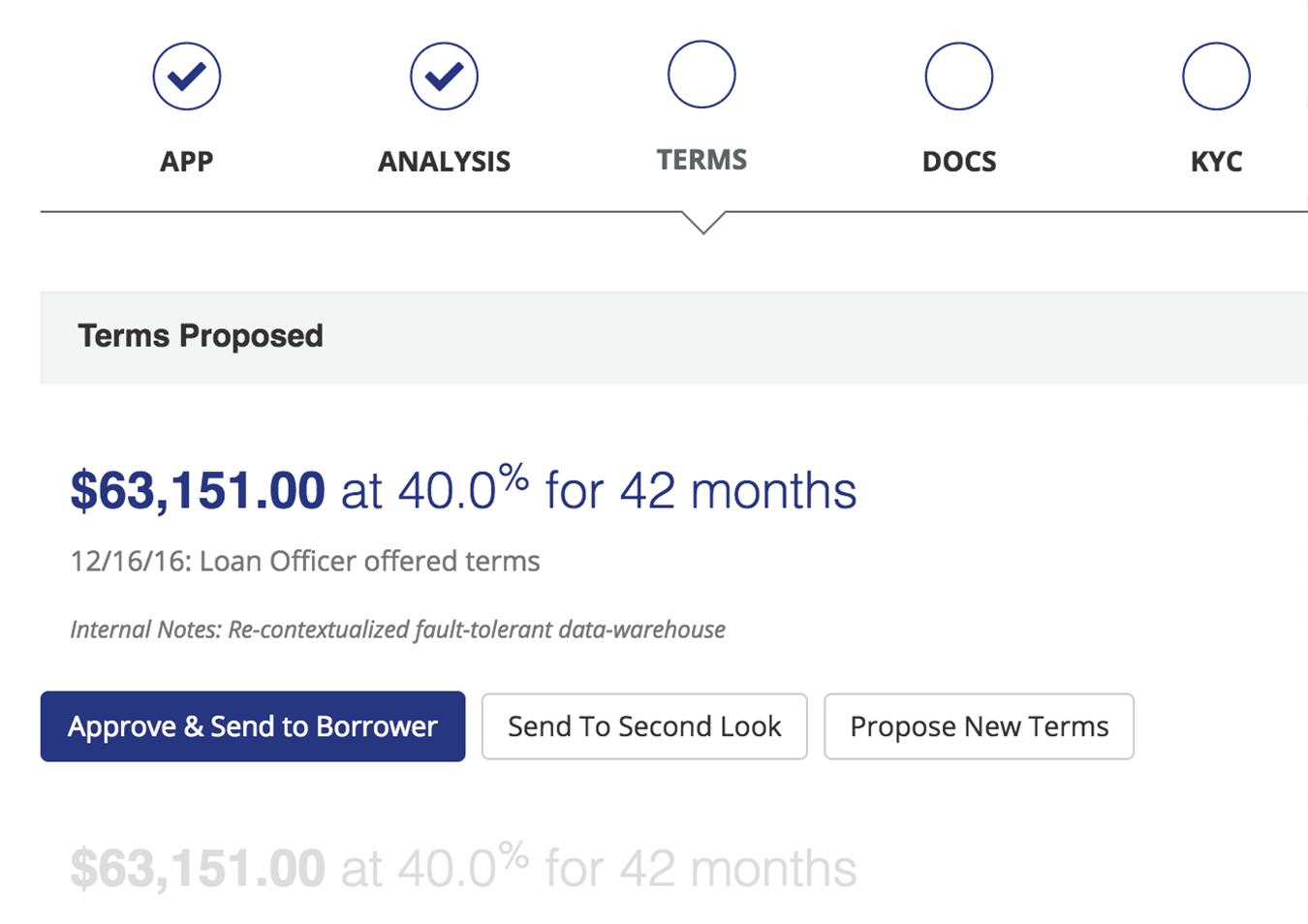

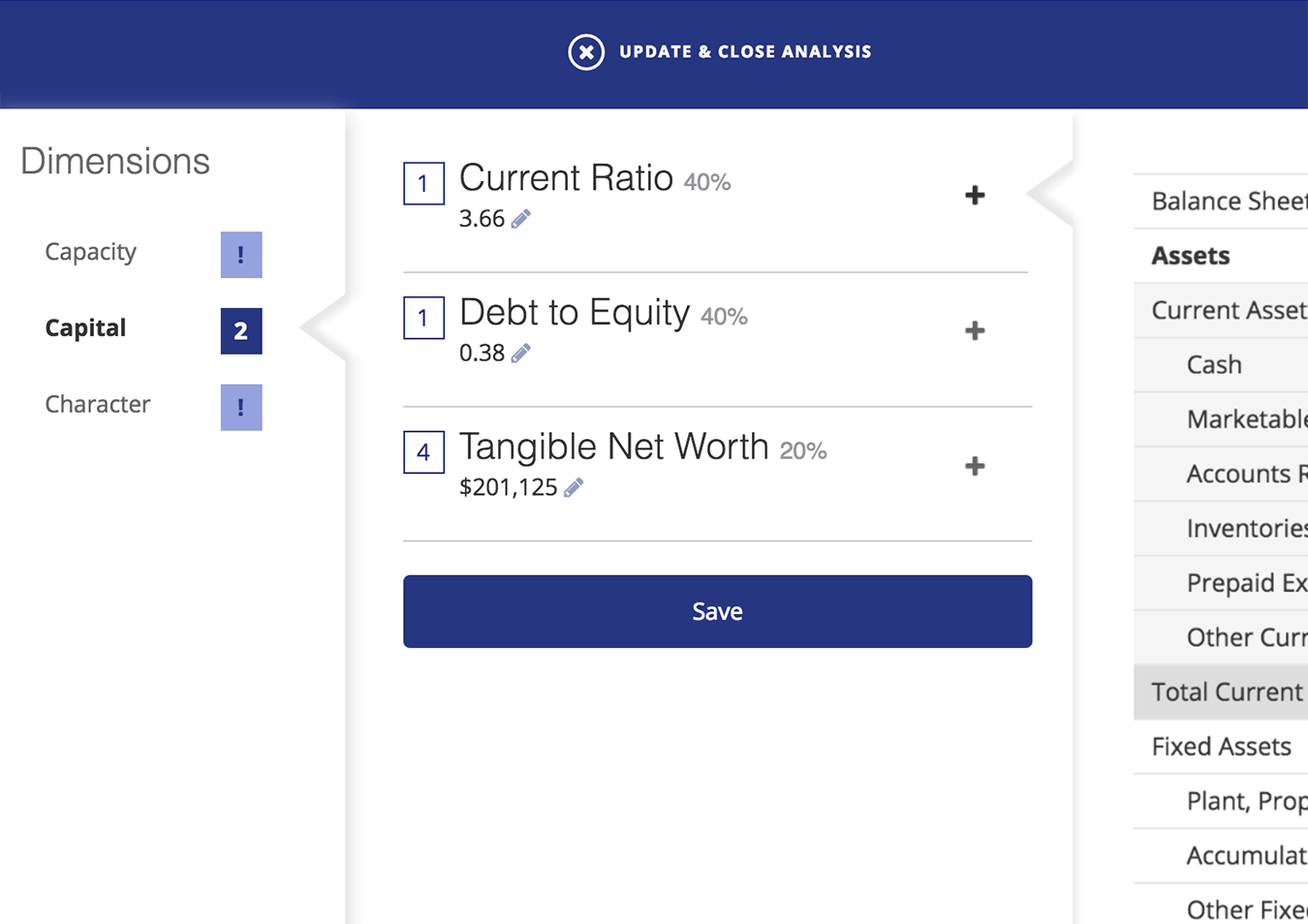

Bank Portal

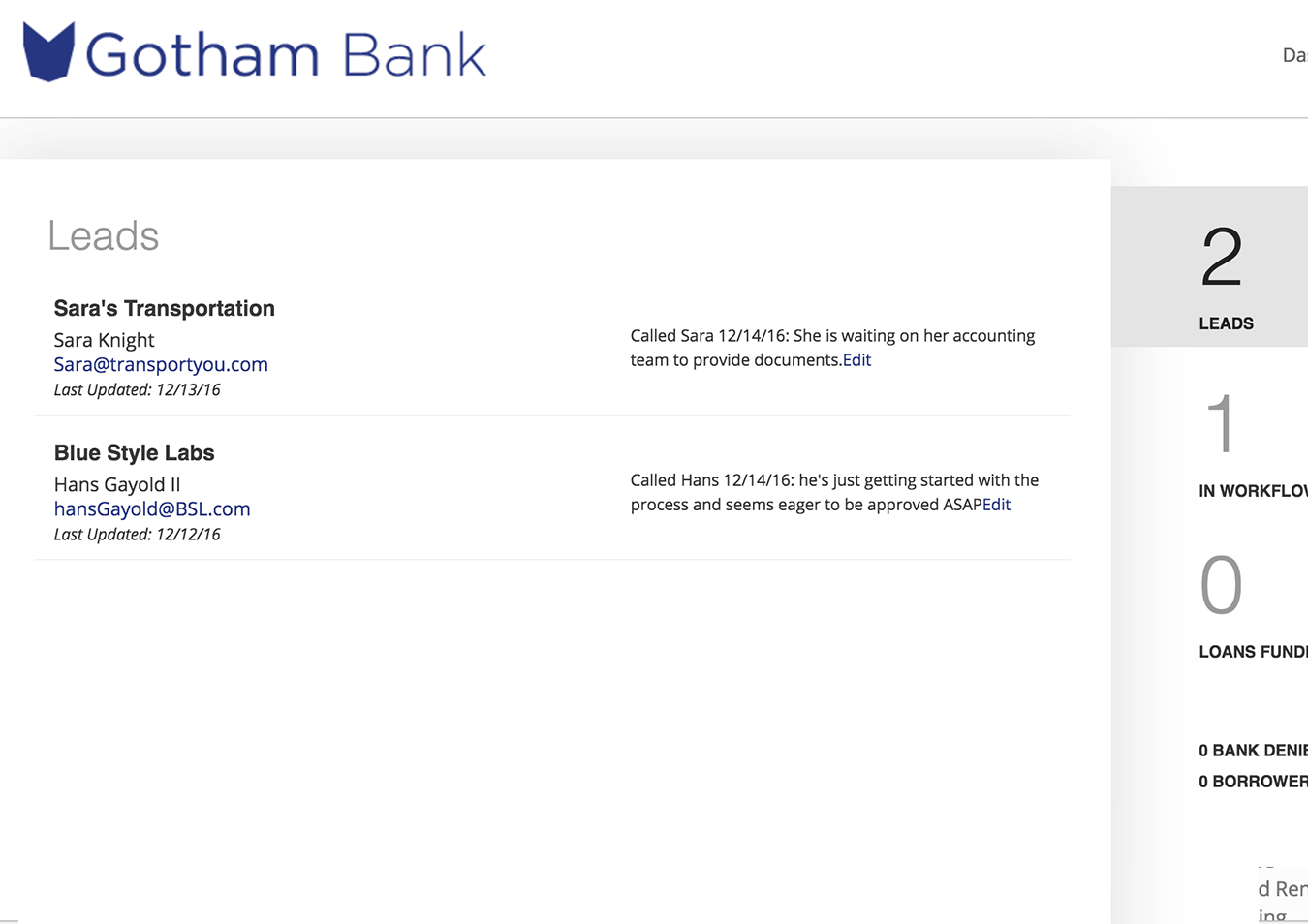

Now to the complicated part of understanding the 6 weeks process within banks and shaving it down to 3 days. First, we needed to discover where the inefficiencies are, and determine how to build a digital process that is flexible for the varying sizes of origination teams.

As we started interviewing bank employees we quickly realized we were the bad guys and they were terrified that we are replacing their jobs, this caused some unexpected answers and resulted in an exploration of emotions in order to truly understand the problem.

As we dug deeper we uncovered workflow issues, silos, and communication problems among others. There was a moment I was thinking, ‘I am truly terrified at how much we have to build to solve the problem... Good thing I’m working with an incredibly brilliant, dedicated team.'

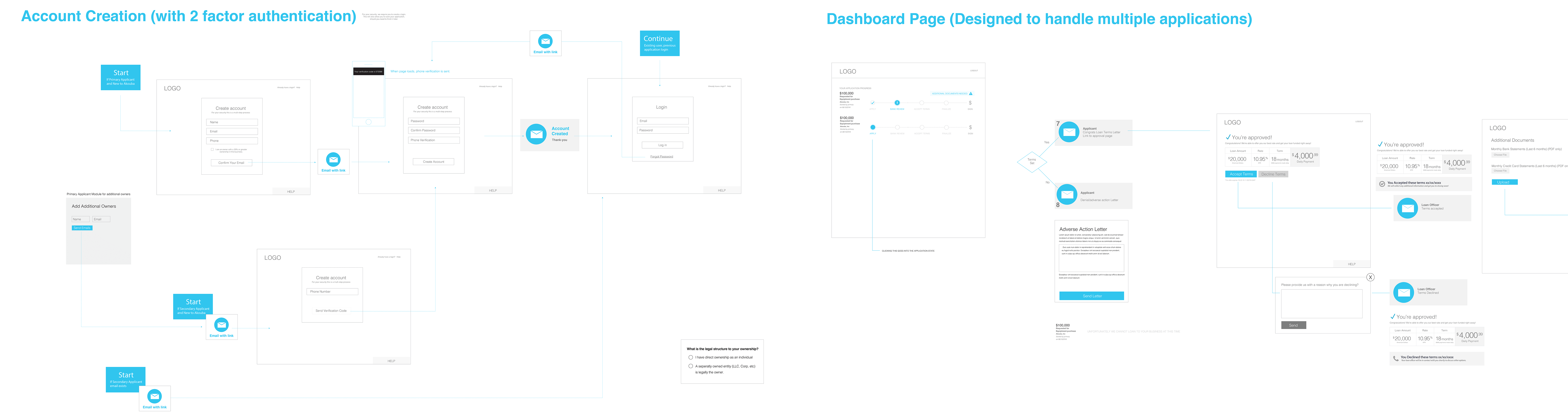

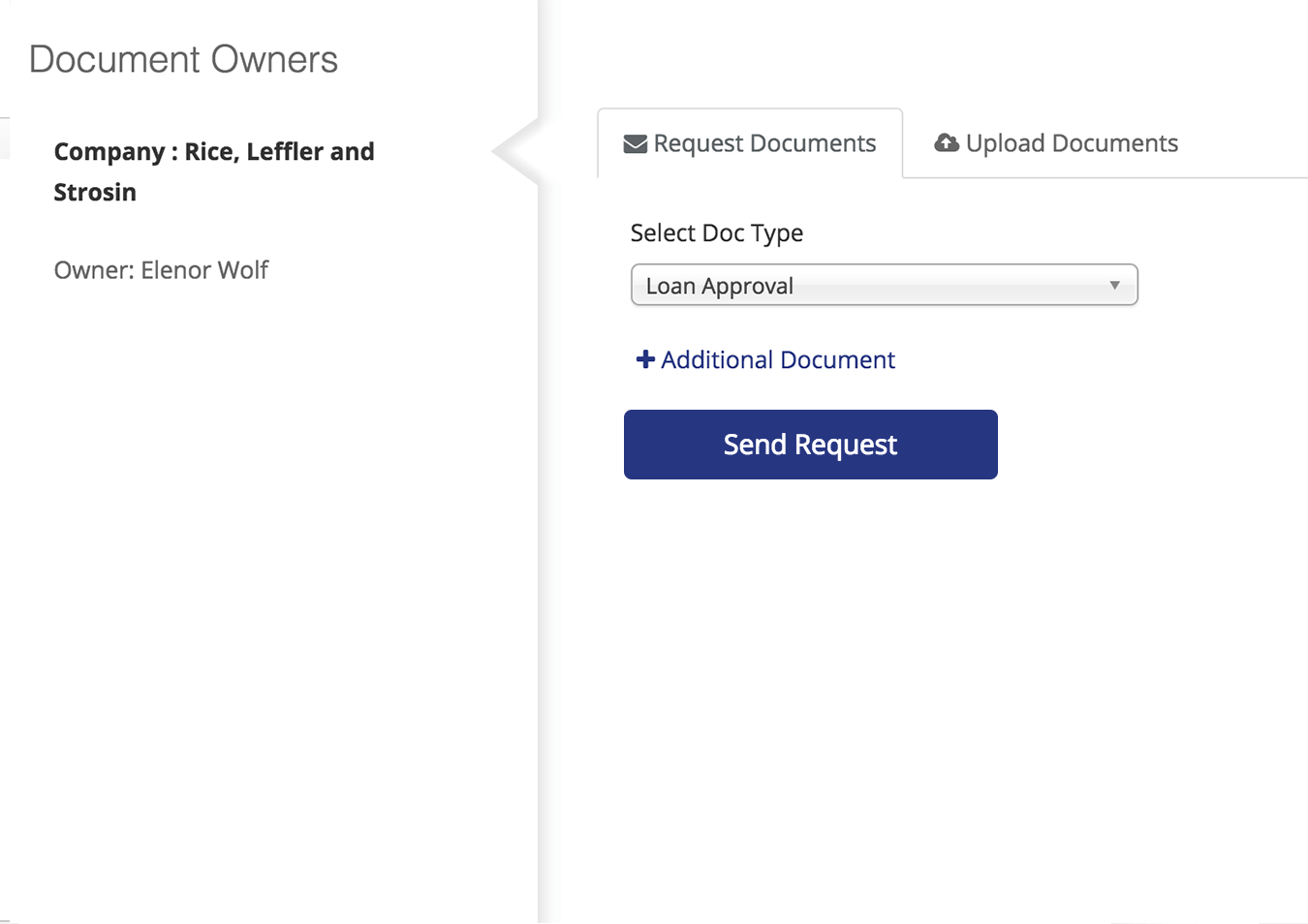

We broke it down to the following six key features that seemed to solve the biggest problems that cause loan origination to take so long in banks.

Key Features

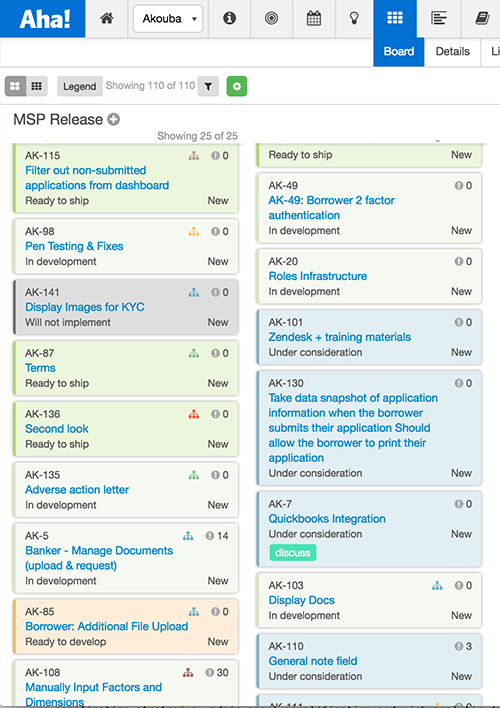

Managing the flow of ideas to solve the numerous problems became a problem in itself. Our small product team of 2-3 people required some structure so we turned to aha.io to keep track of the growing feature list. Looking back, we wouldn’t be where we are at today without aha.

Once we nailed down our roadmap we started building. We built smart, and iteratively with the end goal in mind. A platform like this has so many dependencies between each feature, especially when starting from nothing. We released a demo for sales - got some customers and continued to add on features based on the feedback we were receiving in the field. The network of professionals I built allowed us to work faster, and under fewer assumptions.

We recently released a new demo with our latest build. It’s a turnkey solution, and it’s only going to get better with time.

Lessons Learned

Taking a product from start to on boarding with such a small team has been an incredible experience. I’ve had to get crafty when it comes to building demos, asking for feedback, and organizing discussions.

After all, I love a good challenge with a great team.

Akouba is an industry leading, endorsed small business origination platform that is gaining serious momentum in the Fintech space. We are continually receiving praise on the user experience and ingenuity that went into building the platform. Our small team of rockstars has built an incredible piece of software along with amazing company culture.